maryland electric vehicle tax incentive

Up to 26 million allocated for each fiscal year 2021 2022 2023 Would apply to new vehicles purchased on or after July 1 2017 but before July 1 2023 3000 tax credit for. Most if not all of the.

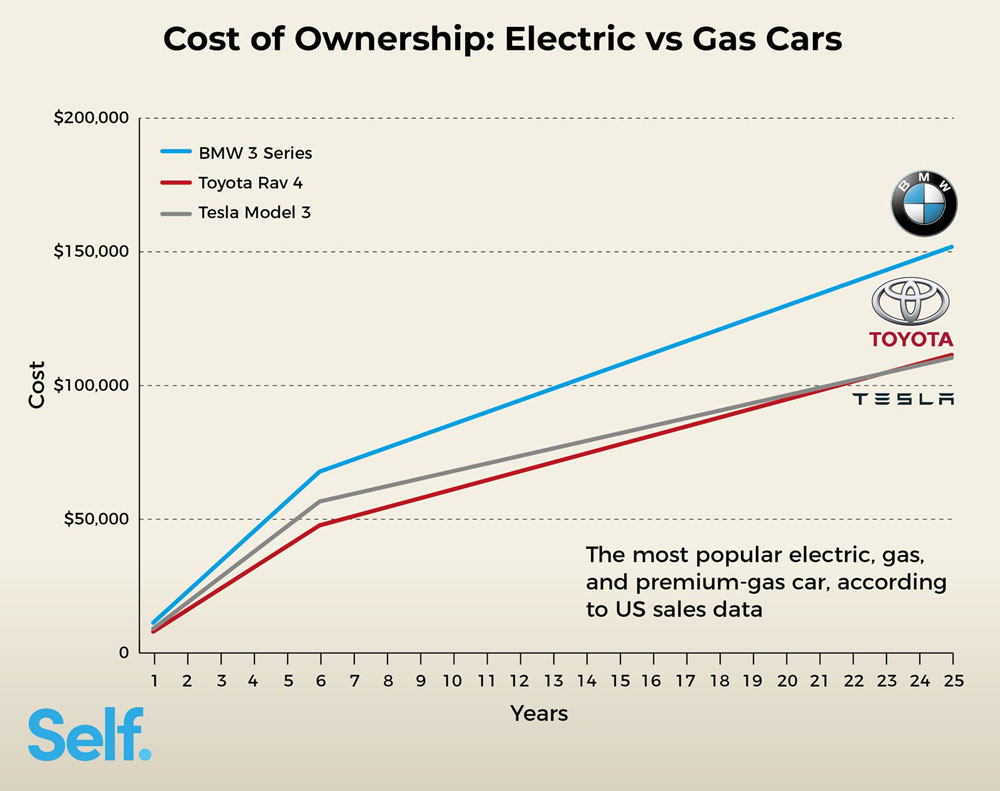

Electric Cars Vs Gas Cars Cost In Each State Self Financial

The Maryland Natural Gas Voucher Program provides financial assistance for the purchase of new and converted natural gas vehicles registered in the state of Maryland.

. Reduced Vehicle License Tax and carpool lane access. Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid. The time to go electric is now with Nissans Award-Winning Electric Car Lineup.

Maryland offers individuals who purchase or lease a qualifying plug-in electric vehicle a one-time excise PEV tax credit of up to 3000 while funds last. EV Charging Station Directory SMECO EV Recharge Stations Incentives for buying Depending on the available funding federal and state governments have credits and rebates available to. Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in.

Listed below are the summaries of all current Maryland laws incentives regulations funding opportunities and other initiatives related to alternative fuels. Maryland also has an incentive that allows electric vehicles to use high-occupancy vehicle HOV lanes no matter how many passengers are in the car. Beginning July 1 2023 qualified EV and FCEV purchasers may apply for an excise tax credit of up to 3000.

Community Solar Allows Maryland residents to purchase subscriptions for energy from community solar arrays. Tax credits depend on the size of the vehicle and the capacity of its battery. The list below contains summaries of all Maryland laws and incentives related to electricity.

The Maryland Energy Administration MEA manages grants loans rebates and tax incentives designed to help attain Maryla nds Goals in energy reduction renewable energy climate. Ad Learn More about the All Electric 2022 Chevrolet Bolt EUV on the Official Chevy Site. Up to 1000 state tax credit Local and Utility Incentives.

Renewable Fuel Standard or Mandate. Fuel Production or Quality. Owning an electric car can also be environmentally friendly substanial.

Receive tax credits for purchasing biofuels. Even local businesses get a break if. Anticipated Program BudgetThe total amount of funding currently available for this rebate program in state fiscal year FY 2022 7122- 63023 is up to 1800000.

Ad The future of driving is electric. Electric Vehicles Solar and Energy Storage. Be a resident of.

Effective July 1 2023 through June 30 2027 an individual may be entitled to receive an excise tax credit on a qualifying zero-emission plug-in electric or fuel cell electric vehicle regardless of. Electric car buyers can receive a federal tax credit worth 2500 to 7500. The tax credit is first-come first-served and is limited to one vehicle per individual.

Get more power than ever with Nissan Electric Vehicles. Maryland Laws and Incentives. State Incentives Alternative Fuel Vehicle AFV Grants.

To receive your 300 rebate you must. How to get Maryland electric vehicle incentive You can get one EV charger rebate from one of the utility providers. Electric Vehicle EV and Fuel Cell Electric.

If you have mailed in your application we ask that you contact us via phone at 410-537-4000 or 1-800-72-ENERGY or email at DLInfo_MEAmarylandgov to confirm receipt. The Maryland Department of Environment MDE offers grants for the installation of EV charging stations at workplaces through the Charge Ahead Grant Program CAGP. Plenty of Space and Good Looks Explore the 2022 Chevrolet Bolt EUV.

Ad Here are some of the tax incentives you can expect if you own an EV car.

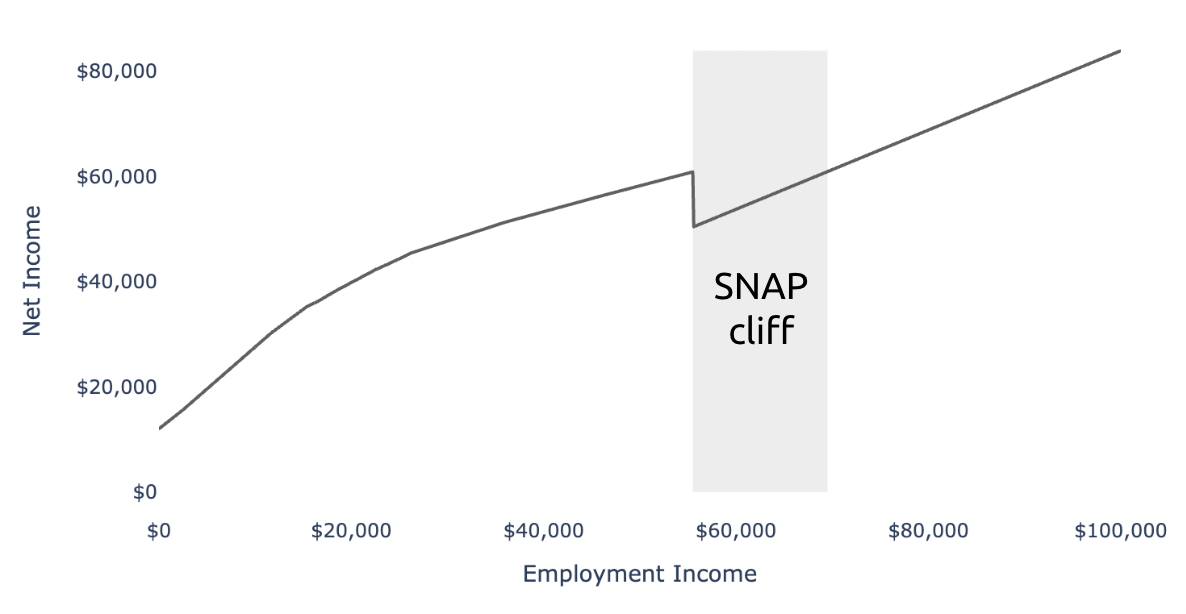

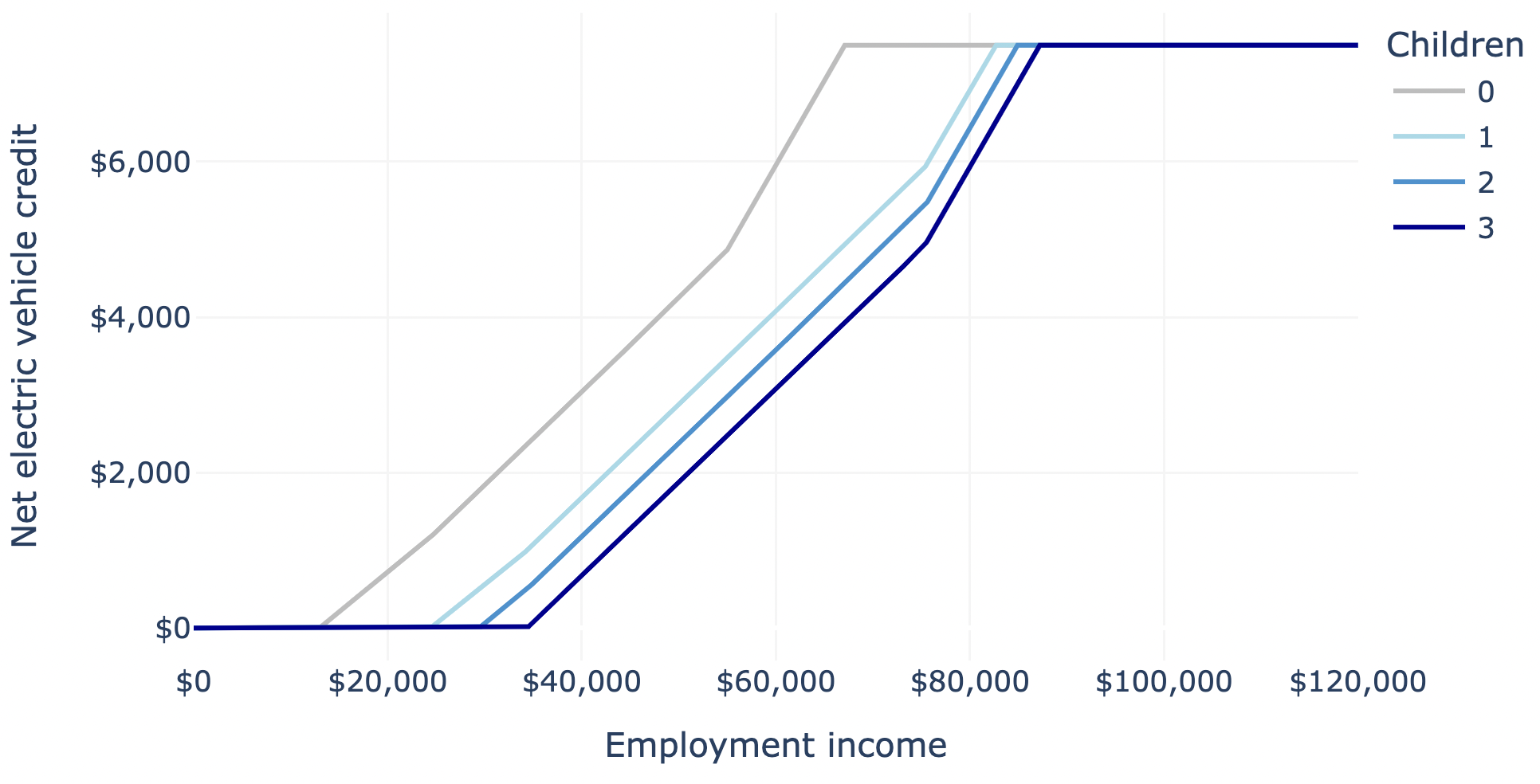

The Inflation Reduction Act Discourages Electric Vehicle Buyers From Working

Electric Vehicle Orders Are Zooming At Ford Scientific American

Electric Car Salary Sacrifice Ev Salary Sacrifice Fleet Evolution

Electric Vehicles Charge Ahead In Statehouses Minnesota Reformer

Electric Vehicles Charge Ahead In Statehouses Minnesota Reformer

The Inflation Reduction Act Discourages Electric Vehicle Buyers From Working

The Inflation Reduction Act Discourages Electric Vehicle Buyers From Working

These Electric Cars Deliver The Most Bang For The Buck

Ev Tax Credit In Inflation Reduction Act Very Limiting Most Vehicles Immediately Ineligible

Do Evs Save Money Over Gas Engines Leafscore

The Inflation Reduction Act Discourages Electric Vehicle Buyers From Working

Vehicle Emissions Inspection Program Veip Pages

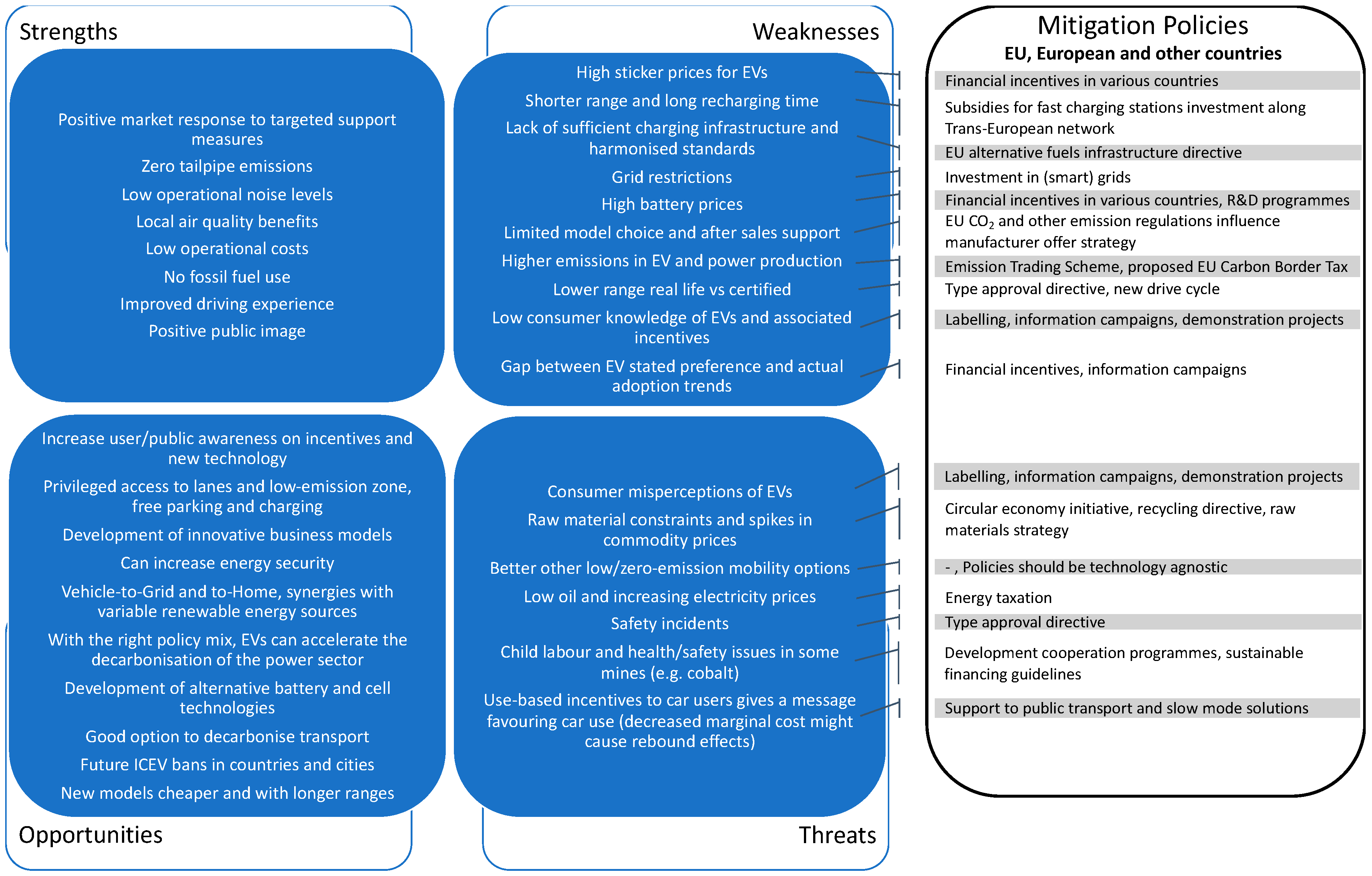

Energies Free Full Text Will Electric Vehicles Be Killed Again Or Are They The Next Mobility Killer App Html

Vehicle Emissions Inspection Program Veip Pages

Electric Cars Vs Gas Cars Cost In Each State Self Financial

Charging Incentives Support Growing Virginia Ev Adoption Virginia Clean Cities

Joe Manchin Says Ludicrous Electric Vehicle Tax Credit Not Needed Bloomberg

Charging Incentives Support Growing Virginia Ev Adoption Virginia Clean Cities